Listen up everyone. Stop stressing over meaningless positions … You’re wasting valuable time.

While investors clutch their portfolios and check their phones every five minutes, I just closed out a beautiful trade that proves something critical:

This 2026 volatility isn’t the enemy. It’s an opportunity.

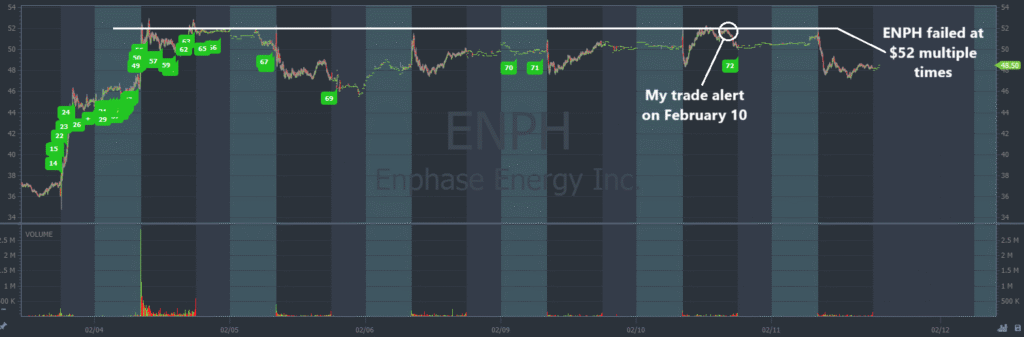

Last Wednesday, February 4, a little-known solar energy stock spiked 41% in a single session.

It was a decent move. But I was more excited about what was to come next …

Due to the spike, we now had a defined breakout level.

- Would it surge to new highs?

- Or fall back toward the pre-spike level?

I can trade either setup, I just need the price to confirm a direction.

For four straight days, the stock couldn’t push higher. It tried and failed, again and again, at the breakout level. That’s not the usual consolidation we see before a spike higher … That’s exhaustion.

And when I see exhaustion after a parabolic move, I know what’s coming next.

Bearish momentum.

On February 10, I capitalized on the pullback after another failed push higher. And I alerted the trade in everyone’s email …

We don’t need to short sell to gain from stocks rolling over. Options contracts give us the ability to position for downside moves without the unlimited risk that’s associated with traditional short selling.

These patterns repeat over and over again in the market. Both bullish and bearish.

Don’t miss the next obvious price swing.

Another Momentum Trade

On February 3 during after hours, Enphase Energy Inc. (NASDAQ: ENPH) announced bullish earnings for Q4. It spiked 41% into February 4.

The stock traded sideways after the spike and tried to push past the breakout level a few times, but it kept failing.

Finally, on February 10, it failed at least twice intraday, and I sent out an alert to buy Put contracts.

Puts allow us to capitalize on bearish momentum without the extreme risk that comes with short selling.

Here’s the alert I sent out at 2:57 P.M. Eastern. On the chart, every candle represents one trading day:

And here’s my alert overlaid on a chart that shows the intraday price action.

Every candle represents one trading minute:

Notice the next morning, the price flushed lower.

That’s exactly what we were looking for.

On the stock chart, it only moved a few percentage points. But with a short-term options contract, the move is magnified for a huge percent gain.

This isn’t rocket science. I’m just looking for stocks that hold, or can’t hold, key levels. That goes for bearish trades and bullish trades alike.

But I know, hindsight is 20/20.

You can’t capitalize on a trade that’s already happened. And maybe you’re not checking your email in time to get a good position from my alerts …

Here’s my solution: Stop relying on trade alerts altogether.

Attend the Options Trading Bootcamp on February 17 and 18.

Learn everything you need to know in just two days!

It’s completely virtual. You can log in from wherever. But we don’t hold these events very often …

Take advantage of this opportunity.

Stay Street Smart,

Jeff Zananiri

*Past performance does not indicate future results, Not typical.