Everyone’s market feed feels like a horror reel right now.

The iShares Silver Trust (NYSE) recently logged one of its worst days ever, collapsing roughly 36% in a single session on January 30.

Bitcoin knifed to new 2026 lows around $81–83k.

And a fresh tech shakeout, sparked by AI angst and disappointing reactions to earnings, smacked the Nasdaq as software and chip stocks unraveled.

Yes, the nerves are real. No, you don’t need to be nervous.

Volatility can turn into a crisp paycheck for traders who respect levels and understand the price action.

When fear spikes, our patterns show up with more conviction.

Use this fear, get surgical. Use predefined entries and exits, start with a small size, watch for patterns that repeat in the market.

Earlier this week I sent out a trade alert to capitalize on bearish price action from the QQQ …

We can make gains with both types of momentum, bullish and bearish.

My Bearish Trade

We don’t have to go down with the ship when the market is in freefall. And we don’t have to sit the volatility out until there’s a good spot to dip buy …

With options, we can trade the bearish momentum in the market with simple Put contracts.

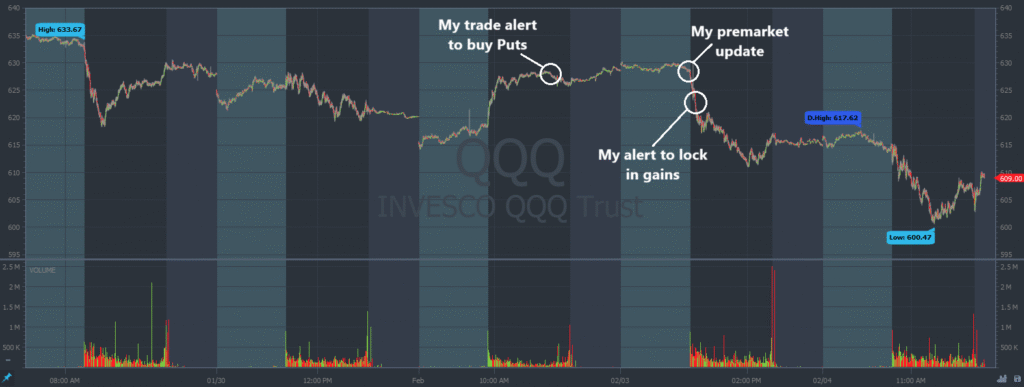

For example, on February 2 I noticed the market was bumping against resistance and unable to push higher, so I sent an alert to buy Put contracts, at 2:27 P.M. ET.

There’s a screen shot below of the message that hit your inbox:

The next morning, February 3, I sent this premarket update at 9:21 A.M. ET, less than 10 minutes before the market opened:

And at 9:55 A.M. ET the trade reached my goals:

Here are my alerts overlaid on the QQQ chart. Every candle represents one trading minute:

That position printed massive gains all day long.

And I was able to make that trade without an emotional bias. I don’t know if the market will spike to new highs next week, or crash to new lows for 2026.

All I care about is the short term price action as it relates to the larger narrative.

- The QQQ looked to have found a top after bumping against resistance.

- The larger market was filled with fear.

- So I made a trade with a clear risk level that matched the chart and the market sentiment.

And I’m not done.

My Next Trade

Keep an eye on your email. We see new trade setups almost every day. And in this volatile market, the potential gains are astronomical.

You already read my final alert from February 3 … There was at least 100% on the table.

The stock only moved a few percentage points, but the options contract surged exponentially.

I hosted a trading bootcamp during February 3 and 4 too …

Everyone who attended got a detailed breakdown of this setup and how to spot the next one on their own.

My goal for you is to be self-sufficient.

I’ll share my trade alerts to help you recognize these patterns in the beginning. But you shouldn’t rely on my alerts for your entire trading career.

Join the Waitlist To Prepare for the Next Bootcamp.

Until then stay glued to your email. I’ll send you a new trade alert soon.

Stay Street Smart,

Jeff Zananiri

*Past performance does not indicate future results, Not typical.