Happy Tuesday, traders…

Jeff here.

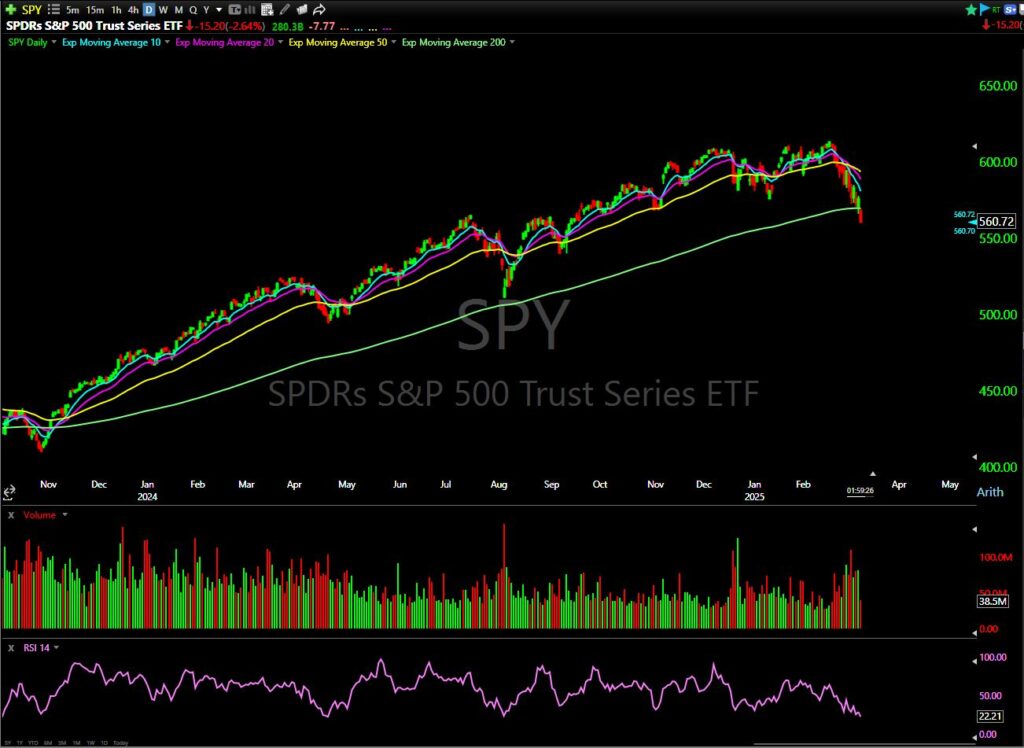

Yesterday, we saw the biggest single-day decline since the market started rolling over on February 19, with the S&P 500 and Nasdaq down 3.2% and 4.4%, respectively:

This price action will wipe some traders out.

But most traders don’t get wiped out because they take bad trades. They get wiped out because they refuse to admit they’re wrong.

They try to pick the exact bottom, load up on calls, and make heroic predictions.

I know because I’ve been guilty of some of these mistakes myself. But the difference is I always have a hedge.

If you’re trading without protection in this market, you’re playing Russian roulette with your portfolio.

And if you think some stocks are “safe” just because they’re holding up better than others, you’re in for a rude awakening.

With that in mind, here are three tips on what I’m doing, what I’m avoiding, and how to survive while the market keeps grinding lower.

It’s time to pay attention — this just might save your account…

Don’t Try to Call “The Bottom”

First, let’s talk about something that gets a lot of traders in trouble: trying to pick the bottom.

I get it. It’s tempting. You see a stock beaten down, and you think, “This has to be the low.”

You jump in, expecting a bounce. Sometimes, you get lucky. But most of the time, you don’t.

I have no problem admitting that I fell into the same trap last week. I was buying calls on some of these crushed names, hoping for a rebound, and it didn’t work…

But here’s the difference between me and a lot of traders who get burned:

I always have puts. If I put $1 into a call, I’m putting at least 50 cents into a put.

Because the reality is, you don’t know where the bottom is. The market doesn’t care about what should happen. And if you’re just long because you think it’s the bottom, you’re setting yourself up for disaster.

That’s why I always say: bottom pickers get dirty fingers.

It’s fine to miss the first 3% of a real market bottom. You’ll make your money on the way up.

But sitting through this kind of market without holding puts to hedge your risk? That’s a fast track to blowing up your account.

I’ve seen too many traders get wiped out because they refused to hedge. They convinced themselves that a certain stock had to bounce.

And when it didn’t, they were stuck. Illiquid. Insolvent. Blown up.

Let’s make sure that doesn’t happen to you.

Don’t Get Stuck in Losing Trades

Now, let’s talk about another mistake traders make in this kind of market: getting stuck in losing trades.

You have to keep the inventory fresh.

You can’t sit there holding onto a trade just because you want it to work. If it’s not moving in your favor, cut it and move on. The worst thing you can do is dig in and hope. Hope is not a strategy.

Every day, I’m adjusting my trades. Taking profits. Cutting losers. Rolling into new positions.

I’m not letting myself get anchored to anything because, in a bear market, the only thing you can count on is continued selling…

Don’t Fall for “Relative Strength”

This brings me to my third point: There’s no such thing as relative strength in a bear market.

Traders love to talk about “safe havens” — defensive names, bond ETFs, gold, etc. They see a chart holding up better than the rest and assume it’s strong.

But in a bear market, no one escapes.

If a stock is looking “relatively strong,” all that means is the bears haven’t attacked it … yet.

But they will. And when they do, it’s going to get ugly.

That’s why you can’t fall into the trap of thinking, “This stock is holding up, so it must be safe.”

Trust me, it’s not.

In tapes like this one, long-term investors start selling everything.

They panic. They want to lock in profits before their winners turn into losers. That selling feeds on itself. It spreads like a disease from sector to sector, stock to stock.

And before you know it, the “strong” names get taken down just like the weak ones.

This is why you have to stay flexible. You have to keep moving. You have to protect yourself.

A lot of traders are about to learn these lessons the hard way.

Don’t be one of them.

Stay cautious, stay nimble, and hedge your bets,

Jeff Zananiri

P.S. The game has changed in the past few weeks — that’s undeniable.

The question is: Are you adapting?

My go-to strategy right now is Burn Notice trades. They’re quick, overnight options plays that won’t overexpose you to broader market risk.

So, if you want to understand exactly how (and why) these trades are perfect in this environment…

Join Jordan Phee for a LIVE BURN NOTICE WORKSHOP … TODAY, March 11 at 10:00 a.m. EST

This is your last chance to sign up — Click here to reserve your seat.