Good morning, traders…

Jeff here.

Yesterday, the Federal Reserve concluded its two-day Federal Open Market Committee (FOMC) meeting…

The FOMC plays a pivotal role in the U.S. economy by setting monetary policy, which directly impacts interest rates, causing broader implications for financial markets.

While Powell’s tone was mostly positive, most of the committee’s projection numbers are moving in the wrong direction.

Here’s what we learned:

- Rates are staying where they are, no shocker there. But under the hood, the big-picture forces that move the market are starting to show some cracks.

- The benchmark borrowing rate is steady between 4.25% and 4.5%, the same level since December.

- However, the FOMC lowered its economic growth forecast and slightly raised its inflation outlook.

- Plus, policymakers now expect the economy to grow at just 1.7% this year, a 0.4% drop from their previous estimate in December.

Ultimately, what traders care about is inflation (and how it might influence the Fed’s interest rate decisions).

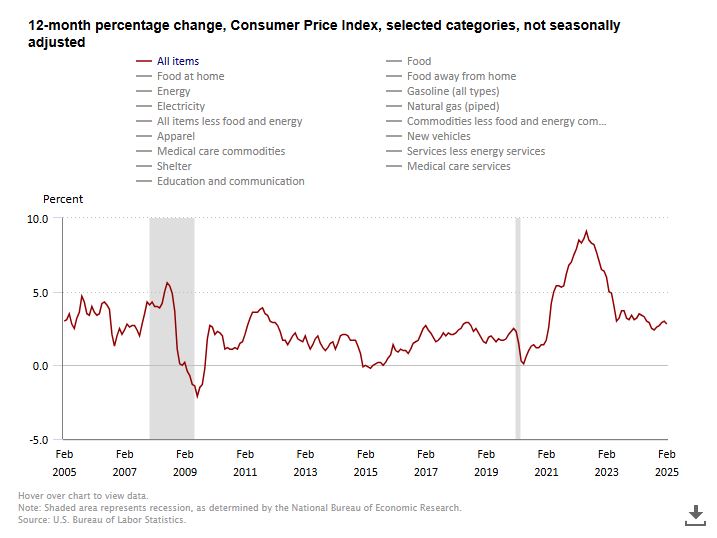

And while inflation is sticky, it’s been going in the right direction (unlike these other Fed projections).

We’ve gone from over 9% inflation in the CPI (June 2022) to 3% (currently):

A worst-case scenario would be if GDP growth slows while inflation stays sticky, that’s called stagflation — something the market is getting increasingly worried about.

These broader economic factors are crucially important right now. If you aren’t closely watching these macro indicators to gauge the big picture, you’re trading with blinders on.

And that’s especially true this week when it’s all about the Fed.

With that in mind, here are three key tips for trading the post-Fed price action like a pro…

Size Down Your Positions

More than anything, I recommend sizing down and trading smaller positions this week.

Why? Because this market can flip at any moment, and we don’t want to be left holding a large bag at the wrong time.

Smaller positions give you more wiggle room to make mistakes (especially if you’re trading a small account).

The most important thing is that you go on to trade another day. Never risk more than you’re willing to lose.

I can’t tell you how many traders I’ve seen blow their entire careers on a few poorly-sized trades.

WARNING: Sizing too big into a loser is a much bigger mistake than sizing too small into a winner.

Think about it like this…

If you’re unhappy after a winning trade because you didn’t bet more money, that’s greed rearing its ugly head.

You should be excited about your strategy working — not disappointed that you didn’t make more money.

Be very deliberate with your position sizing and you’ll be a better trader for it.

Then, you should also be very deliberate with something else…

Book Profits Quickly

Suppose you’re lucky and disciplined enough to find yourself in a five-star setup, where your contracts are surging.

In that case, it’s time to immediately identify another price target — the level where you’ll book profits.

If a trade’s going well, greed is your worst enemy. You’ve gotta fight the urge to hold out for unrealistic price targets.

To use a soccer analogy: Be satisfied scoring a double … don’t injure yourself going for a hat trick.

This is especially true during a week like this one when major Fed catalysts can rock the market in minutes.

I want you to be greedy with your gains this week. For example…

If you’re up 50% on an options trade, don’t hold out for 75-100%.

Lock your profits up and move on to the next play.

This is easier said than done. There’s a constant war in traders’ heads between holding runners and booking profits quickly.

But this week, with the Fed dominating the narrative, it’s more important than ever to grab your unrealized gains while you still have them.

Focus on Your Game Plan

Too many traders fail to form a solid game plan before entering their trades…

Why? Because they’re impatient, greedy … or both.

Every successful trader I know has their game plan prepared before they enter a trade.

On the contrary, many newbies attempt to throw their entire account at options trade, dreaming of making millions in a single trading day.

(Just look at r/WallStreetBets for thousands of examples of this mentality.)

But the vast majority of these wild fantasies will never come true…

You can’t take more than the market’s willing to give. You’ve gotta choose your trades carefully and be consistent with your game plan.

So, what details should go into your trading plans? Here’s what I always include…

- Key price levels (support and resistance)…

- Any upcoming catalysts that could affect the share price…

- Position size (the number of contracts I want to trade)…

- Profit target and risk level…

- Potential entry and exit prices…

If you make a trade without knowing those five things, you’re practically begging to lose.

But the opposite is also true. So, make sure you’re always forming an airtight game before entering any trades.

Let’s see how the market reacts to the Fed over the next few days.

Happy trading,

Jeff Zananiri

P.S. In a market this unpredictable, there’s no better strategy than Burn Notice trades…

They’re quick, overnight options plays that won’t overexpose you to broader market risk.

If you want to understand exactly how (and why) these trades are perfect in this environment…

Join Danny Phee for a LIVE BURN NOTICE WORKSHOP … This SUNDAY, March 23 at 1:00 p.m. EST

Stop guessing, start burning — Click here to reserve your seat.

*Past performance does not indicate future results