There’s a massive catalyst growing behind closed doors right now…

It could change everything by Monday morning…

And when I say “everything” I mean: the world as we know it.

Most people are going about their week like it’s business as usual:

- Trips to the grocery store.

- Taking their kids to sports and after-school clubs.

- Golf course outings in the afternoon.

But the catalyst unfolding in the background is already affecting the market. And it could flip the world on its head in the next few days.

As of Wednesday, February 18, the U.S. military is prepared to strike Iran as early as this weekend, February 21 and 22.

Two aircraft carriers are converging in the Middle East. The USS Abraham Lincoln is already there. The USS Gerald Ford, the most advanced carrier group in the American arsenal, could arrive in the region by Saturday.

U.S. Air Force assets in the United Kingdom, including fighter jets and refueling tankers, are being repositioned closer to Iran.

Diplomacy is still technically alive. U.S. and Iranian negotiators sat across from each other in Geneva on Tuesday, but left without a clear resolution.

Meanwhile, Iran is using concrete and soil to fortify its nuclear facilities.

The White House already bombed some of Iran’s suspected nuclear compounds in June 2025.

Satellite imagery confirms the country’s recent scramble for defense … negotiations or not, Iran is prepared for impact.

I hope this ends at the table, not on a battlefield. Nobody wins when the world is on fire.

But I can’t trade with “hope”…

History shows that a military strike on Iran could send shockwaves through oil markets and defense stocks almost instantly.

I’m hoping for peace.

But I’m positioned for profits.

Trades During Global Terror

Every time the U.S. and Iran inch closer to conflict, the oil markets react the same way.

In 1979, the Iranian Revolution took 2.5 million barrels per day off the global market almost overnight. Oil prices doubled in less than a year.

In 1990, when Iraq invaded Kuwait and threatened regional stability, crude spiked nearly 130% in three months.

After the U.S. assassination of Iranian General Qasem Soleimani in January 2020, oil jumped 4% in a single session on fears Iran would retaliate by targeting supply routes through the Strait of Hormuz: the narrow chokepoint that handles roughly 20% of the world’s seaborne oil trade.

The pattern never changes: Middle East tensions spike and oil prices follow.

Last June, this pattern played out again.

On June 13, 2025, Israel launched strikes on Iran’s nuclear facilities. Oil futures surged roughly 7% in a single session.

Then the U.S. joined in. American forces struck three Iranian nuclear sites: Fordo, Natanz, and Esfahan.

The market panicked, and energy stocks exploded higher.

Then thankfully, a ceasefire came. Oil prices eased. And the world exhaled.

But Trump never stopped watching Iran.

He’s warned ever since June that the next move would be “far worse” if Iran didn’t negotiate in good faith.

The military buildup happening right now is a continuation of a policy that already drew blood less than a year ago.

And the oil market is already moving …

Energy Stocks

Oil and gas stocks spiked earlier this week after Iran and the U.S. couldn’t reach an agreement concerning nuclear arms.

Within the sector, one stock in particular is showing us a lot of good momentum.

Battalion Oil Corporation (AMEX: BATL) is a small independent oil and gas producer that operates in the Delaware Basin.

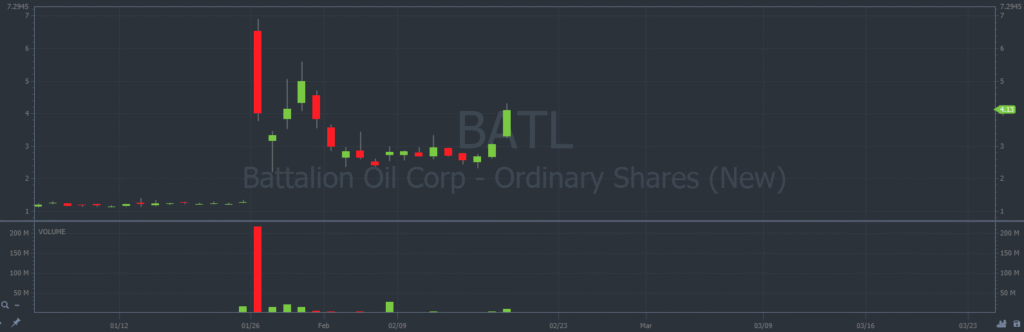

On January 26, the last time U.S.-Iran tensions emerged in the headlines, BATL exploded 438%*.

On February 19, with the threat of strikes back on the front page, BATL surged 79%…

You can see both moves on the chart below. Every candle represents one trading day:

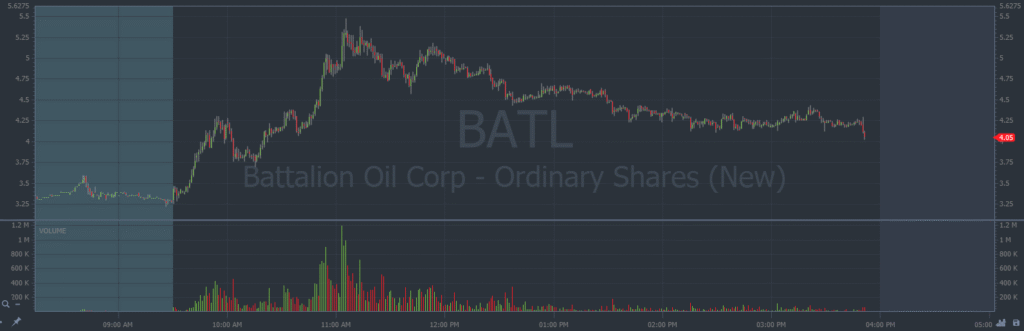

Here’s a chart of BATL’s intraday price action from February 19.

Notice the consolidation into the close. That’s a hint the price could rally higher.

Every candle represents one trading minute:

The same stock. The same pattern. With a refreshed headline.

The market has a memory. And right now, it’s remembering exactly what happened the last time these two countries were staring each other down.

Keep an eye on the headlines.

The entire oil and gas sector is watching with bated breath right now.

Talk about a powder keg waiting for a spark …

Stay Street Smart,

Jeff Zananiri

*Past performance does not indicate future results, Not typical.