We’re in a market right now that could boost your account to the next level, or smack you in the face as it flies right by.

Every day I send traders a two-stock watchlist at the start of the session.

This market doesn’t wait around. Big moves are happening before most traders even boot up their screens.

And if you’re not checking your email at the beginning of the day… You’re missing them.

Just yesterday, December 16, both of the watchlist picks met our goals:

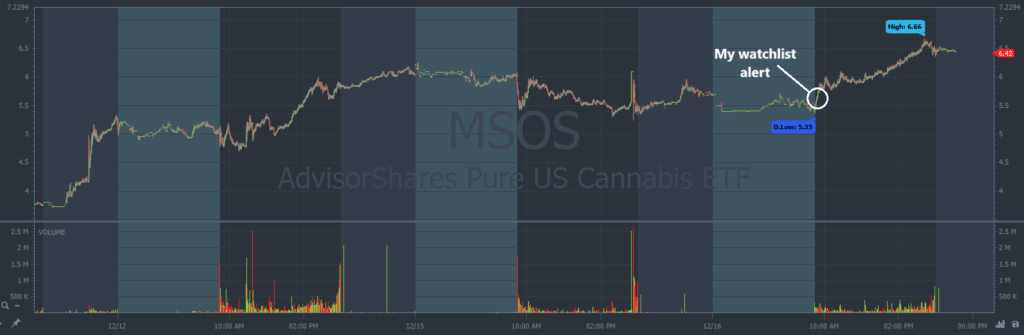

- MSOS: The weed stock ripping alongside Trump’s reclassification news. It ran higher all day after my alert. The chart is below, every candle represent one trading minute:

ARM: Tech stocks have been sliding, with the Nasdaq weakening as key tech names and chip stocks lead the pullback. I was looking for this stock to fall further. On the chart below, every candle represents one trading minute:

With options, we can play both sides of this momentum.

You don’t have to watch charts all day. Just check your email at the start of the session for the two hottest setups.

Curious to see how I pick these trades?

My Process For Trading

Across the industry, most all successful trades boil down to two main factors:

- News catalysts, or a reason for the move.

- And technical analysis that tells us when to enter.

Both my watchlist picks showed us these two factors.

#1: Weed Stocks

The latest surge in cannabis stocks is directly tied to Donald Trump’s push to reclassify marijuana under federal law. A move that could reshape the entire industry.

Reports indicate Trump’s team is exploring a plan to reschedule cannabis from Schedule I to Schedule III, effectively acknowledging its medical use and dramatically easing restrictions on research and taxation for weed companies.

This potential shift has ignited a wave of optimism across the sector. Traders are piling into U.S. multi-state operators like MSOS, betting that looser federal rules could finally unlock institutional investment and broader state-level expansion.

MSOS was already running before my alert on December 16. This catalyst first gained steam on December 12.

When I sent out my trade signal, prices were pushing toward the breakout level.

Look at the full chart of MSOS below, every candle represents one trading minute:

#2: Tech Weakness

The tech sector is under genuine pressure right now. And it’s showing up across major market assets.

The Nasdaq has recently lagged behind other indexes as investors rotate out of tech names, with heavyweights like Broadcom plunging more than 10% and dragging the broader tech complex lower.

As another example, Oracle’s recent earnings disappointed. Underscoring investor fears about aggressive capital expenditures on AI infrastructure that may not pay off quickly.

Institutional voices have also expressed doubt about valuations and risk. Some analysts question whether the bullish tech narrative has gotten ahead of itself.

I’m not worried about a tech selloff.

Because I can trade the momentum with Put Contracts.

I liked the setup on ARM because it was a tech stock breaking below multi-month support on December 16.

The Market Never Sleeps – Don’t Fall Behind

Momentum doesn’t disappear. It just rotates to the next hottest sector.

A few months ago, traders couldn’t stop talking about AI stocks. Now, weed stocks are the ones lighting up the screen while tech names cool off.

This constant shift is what makes the current market so powerful … And dangerous for traders who hesitate.

The good news? You don’t need to chase every move. You just need to be in front of the right ones.

That’s why every morning, before the chaos starts, I send out the two hottest stocks on my screen. Setups with real catalysts and a chart to support my trade thesis.

They’re called: 24-Hour Glitch Alerts.

Here’s a screenshot of the alerts from December 16:

Stop watching these moves from the sidelines.

Start your day by checking your email. There’s always another play to make right around the corner.

Once the weed stocks cool off, a different sector will be set ablaze. And traders who catch the shift early have every opportunity to make gains.

Pay attention to my alerts.

Stay Street Smart,

Jeff Zananiri

/par