Good morning, traders,

Jeff here.

The market’s been volatile, and this week started no different.

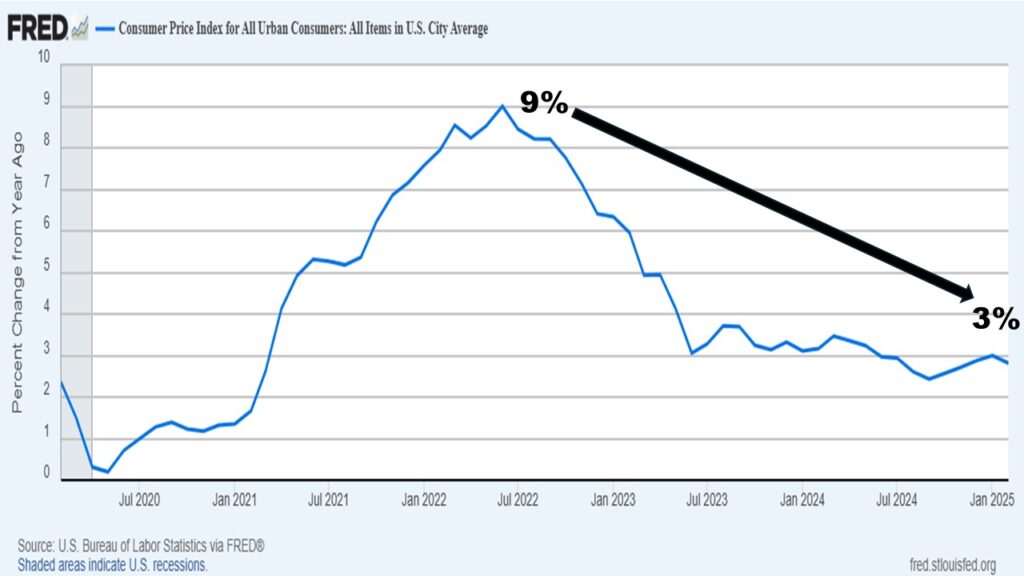

Inflation dropped from 9% (June 2022) to 3%, which is progress—but let’s be real, it’s still here.

Fed Chair Jerome Powell gave a speech last week, and he said the word “uncertain” 21 times. Not exactly a confidence booster.

And now we’ve got Trump’s tariffs coming in hot-bad news for American consumers.

Last week, the S&P 500 dropped 2%, while the NASDAQ was down 2.7%.

The media is already calling for doom and gloom, and honestly, it reminds me a little too much of 2008. Back then, most of the market was bleeding red—except for one key sector that quietly hit new highs while everyone else panicked.

Sound familiar? Because it’s happening again.

Don’t Let the Noise Shake You

I’ve been trading for almost three decades. I’ve seen every kind of market—booms, crashes, sideways chop. And one thing I’ve learned?

Fear leads to bad trades.

That’s why listening to the right people matters.

Not every trade is going to be a winner. That’s just reality. But the right few trades? That’s what makes the difference.

Right now, patience is everything.

Trying to trade like you did last month? That’s a recipe for frustration. This month demands a different approach.

But you don’t need to hit every trade.

A few good trades can make your month.

And I’ve got one that deserves your attention.

Gold Is the Bright Spot

Yesterday, while the market was getting crushed, one sector quietly hit all-time highs.

Gold.

And with Trump’s tariff announcement coming Wednesday, April 2, I expect it to keep running.

That’s why my next trade is clear:

I’m looking at CALLS on GDX (VanEck Gold Miners ETF).

While the market has struggled this year, GDX is already up nearly 35% —and it’s not slowing down.

Trading Is Like Gold Mining

A gold miner’s job is simple: dig up rocks and pull out the gold.

But like trading, it’s a brutal, high-risk business where most people fail.

The process starts with prospecting—finding a spot where gold might be hiding.

That could mean analyzing rock formations, running tests, or following old maps that show where gold has been found before.

A good prospector is part scientist, part detective, and part gambler.

They put in the work before they start digging, so they don’t waste time in the wrong place.

Sound familiar? It should.

Traders do the same thing when researching a stock or setting up an options play.

Urgent warning:

If you want to understand exactly how (and why) these trades are perfect in this environment…

Join me and Danny Phee for a LIVE BURN NOTICE WORKSHOP … TODAY, April 2 at 10:00 a.m. EST

Stop guessing, start burning — Click here to reserve your seat.

Once a miner finds the right spot, the real work begins.

They drill, blast, and haul out tons of rock, looking for tiny flecks of gold buried inside.

It’s not glamorous. It’s hard, sweaty, dangerous work.

The gold isn’t sitting there in big, shiny nuggets. It’s mixed into dirt and stone, and they have to grind it down, extract it, and refine it.

The payout only comes after they do all that work.

That’s trading.

Everyone wants the gold—the big payday—but most aren’t willing to dig.

They want a shortcut.

They chase hot tips, jump into trades without a plan, and expect easy money.

Meanwhile, real traders? They do the research, put in the reps, and know when to take profits.

A gold miner might dig for months before they find anything.

But if they do it right? One big strike can change everything.

Same with trading.

One well-planned trade, one massive move in your favor, and suddenly, all that work pays off.

The difference between winners and losers?

Winners keep digging.

See you at 10 am.

Happy trading,

Jeff Zananiri