Good morning, traders.

Forget the soft GDP print. That was last week’s concern.

On Friday, the April jobs report lit a fire under the market — 177,000 jobs added, beating estimates and sending a clear message.

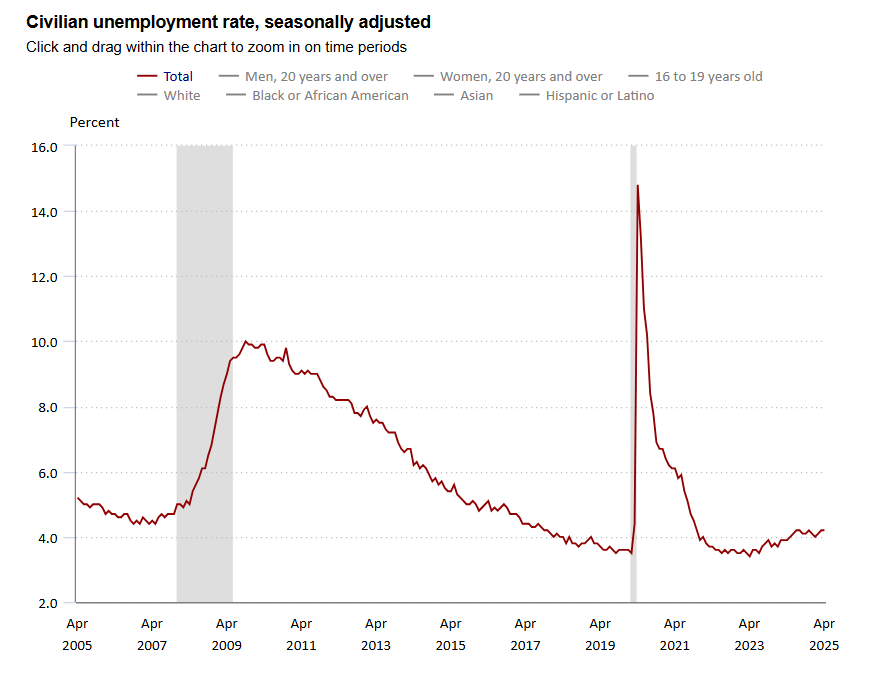

The labor market is still holding strong.The unemployment rate held at 4.2%, wage growth came in steady, and traders quickly shifted their focus from slowdown fears to, “Maybe the Fed doesn’t have to panic after all.”

The reaction? Instant.

The Dow jumped 500 points, snapping its recent losing streak and launching the market back into bullish territory.

Treasury yields bounced, especially the 10-year, as rate-cut expectations got dialed back.

Stocks and bonds both moving higher might sound strange — but in the context of balanced economic data, it actually makes sense.

This was a goldilocks jobs report.

Not too hot, not too cold.

Just enough strength to calm recession talk, but not so strong that it forces the Fed into rate hikes.

What This Means for Options Traders

The takeaway here isn’t just, “Stocks went up.”

The real message is how fast sentiment shifted — from cautious to optimistic, all in a single data release.

That’s where the opportunity lies.

Here’s what I’m watching now:

1. The Fed is still in play

Don’t expect a June rate cut. After Friday, the odds dropped fast.

The Fed has been waiting for signs of real softening in the labor market, and they didn’t get that this week.

That means Powell & Co. have more room to hold steady, even though Trump is still after them to lower rates.

That kind of delay doesn’t kill the rally — but it does reset expectations.

Watch for headlines and Fedspeak this week to reinforce or push back against the market’s take.

2. Volatility is creeping up

Even though the VIX is still hanging in the low teens, don’t get comfortable.

This tug-of-war between economic strength and inflation risk is far from settled.

Each new data point has the power to swing the tape hard in either direction.

For traders, that means opportunities on both sides of the market. Expect sharper moves, especially around morning data drops and Fed-related headlines.

3. Options premiums could start to inflate

If we get more conflicting macro data, implied volatility could rise, especially in individual names.

That sets up beautifully for credit spreads and calendar plays — where you can take advantage of short-term fear without betting on long-term chaos.

Premium sellers should be licking their chops right now.

My Trading Plan for the Week Ahead

Heading into Monday, I’m keeping things neutral to bullish, but I’m not throwing on directional risk just to chase Friday’s pop.

If Friday’s rally holds through today, I’ll be looking for confirmation volume and sector rotation — not just a short-covering bounce.

And don’t ignore the bond market.

If 10-year yields keep pushing higher, the rate-cut crowd may finally back off, which could trigger a subtle change in leadership across sectors.

Growth names that have run hot may cool. Value and cyclicals could start catching bids.

A Sigh of Relief

Friday’s jobs number wasn’t just “good.”

It was the kind of steady beat that gives the market room to breathe.

But don’t get caught flat-footed. This isn’t a “set-it-and-forget-it” environment.

Markets are reacting faster, with bigger moves, and if you’re not ready, you’ll be left behind — or worse, whipsawed out of solid positions.

This is the kind of tape where options traders thrive — if you’re flexible, quick to read sentiment shifts, and smart with your risk.

So, ask yourself: Are you just watching the headlines?

Or are you trading what the market’s actually doing?

Because the setups are coming. The only question is whether you’re ready to act.

Stay nimble,

— Jeff Zananiri

Want to catch the big moves before they hit the headlines?

This Tuesday at 10 a.m., Aaron Hunziker is pulling back the curtain on how he nails fast, overnight wins — even when the market’s throwing curveballs.

If you’ve been guessing your way through this chop … stop. Aaron’s going to show you how he spots explosive setups before the crowd piles in.

👉 Reserve your seat now — space is tight, and this one’s going to fill.

*Past performance does not indicate future results.