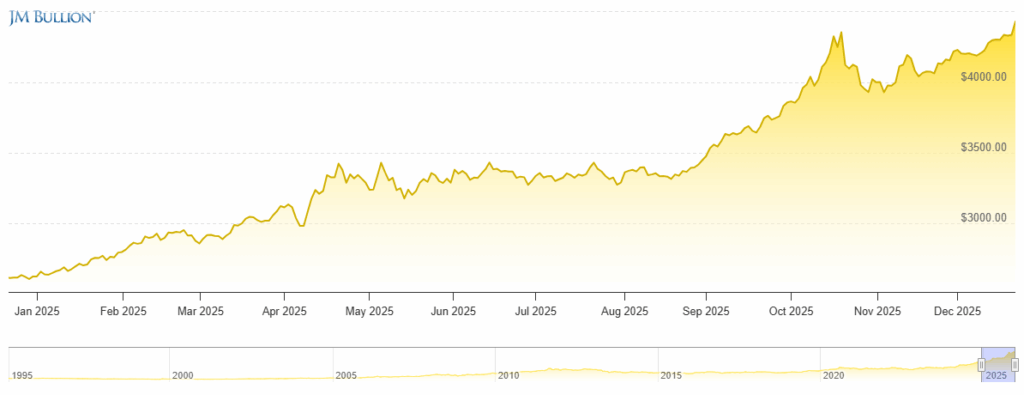

Gold’s having its biggest year in modern history. And it’s not slowing down.

In 2025, prices smashed record after record, blasting through $4,400 an ounce as investors around the world ditch currencies and pile into precious metals.

You can even find gold bars stacked next to bulk coffee at Costco. That’s how mainstream this rush has become.

On the chart below you can see that the spot price of an ounce of gold just broke past all-time highs:

Most people are likely still watching this sector from the sidelines. Unable to truly gain a footing or secure any true wealth.

Gold’s expensive. It’s bulky. And if you’re only buying a few grams at a time, you’re slow going to make any real gains.

But we don’t need to own gold to make gains from the gold rush.

While everyone else is hoarding metal, smart traders are targeting momentum. The entire sector has gone vertical this year. And that means the options contracts for gold stocks are booming.

I built a watchlist that every trader should pay attention to right now. History shows when gold moves like this, the real money flows into the stocks around it.

The rush is on … And this time, it’s not just for miners with picks and shovels.

The real opportunity is for traders.

The Catalyst For Bullish Momentum

Since the beginning of this year’s gold explosion, the catalysts behind it have only gotten stronger.

First, gold is moving because global investors are scrambling for safety.

Geopolitical risks and unresolved trade tensions are pushing people out of risk assets and into hard assets like gold and silver. And that demand isn’t slowing.

This is classic safe-haven behavior, where global uncertainty equals an upside for gold prices.

At the same time, markets are pricing in more Federal Reserve rate cuts in 2026, and lower interest rates make non-yielding assets like gold more attractive.

When yields fall, traders look for alternatives, and gold is the ultimate hedge.

Then there’s the big players. Central banks around the world aren’t selling gold, they’re buying it aggressively, adding to reserves at a pace that’s unprecedented in years. That institutional demand provides a floor on prices that retail buyers alone could never create.

Additionally, the U.S. dollar has wobbled in 2025, making gold cheaper for overseas buyers and widening global demand. A softer greenback also reinforces gold’s appeal as a store of value when confidence in fiat currencies dips.

All of these macro drivers:

- Safe-haven flows

- Expected rate cuts

- Central-bank accumulation

- And currency shifts

They’re stacking on top of each other and feeding the momentum.

It’s a perfect storm.

And in the market, it’s the exact kind of powerful trend that we can ride without ever owning a single ounce of bullion.

My Gold Watchlist

I built a special scan in StocksToTrade that helped me find the most active material stocks in the market.

And from that list, I narrowed it down to 9 different gold stocks that are worth watching right now.

Each of these companies is different. But a quick glance at their charts will show you they’ve been logging higher prices in 2025 thanks to the overall sector strength.

Like the chart of Hycroft Mining Holding Corporation (NASDAQ: HYMC) below. It exploded 59% higher on December 22 to make new 52-week highs.

Every candle represents one trading day:

The watchlist below includes stocks at different price points. I tried to be cognizant of differently sized accounts and different available buying power.

Flip through these recent runners to find a few setups that stand out to you:

- Alamos Gold Inc. (NYSE: AGI)

- Agnico Eagle Mines Limited (NYSE: AEM)

- AngloGold Ashanti PLC (NYSE: AU)

- Eldorado Gold Corporation (NYSE: EGO)

- Gold Fields Limited (NYSE: GFI)

- Harmony Gold Mining Company Limited (NYSE: HMY)

- Hycroft Mining Holding Corporation (NASDAQ: HYMC)

- Newmont Corporation (NYSE: NEM)

- Seabridge Gold Inc. (NYSE: SA)

Remember, the patterns that we trade are always the same.

Whether it’s AI, weed, or gold stocks. The bullish momentum shifts from sector to sector, but our patterns stay the same.

That’s the beauty of this trading process. We can ignore tech stocks in 2026 if the price action turns choppy, and we can focus on the newest bull-run sector instead.

Right now it’s gold.

Stay Street Smart,

Jeff Zananiri