I’m not a soothsayer.

I don’t have a crystal ball.

But I don’t need a crystal ball when the market literally tells us what it’s going to do.

On Monday morning this week, I gave a webinar where I explained my bearish theory for the Invesco QQQ Trust (NASDAQ: QQQ).

To an inexperienced trader, this setup wasn’t obvious. So if you missed it, give yourself a break.

After I explain the move in today’s blog, you’ll be ready for the next one.

Look at the QQQ chart below as it opened for regular trading hours on Monday, December 8. Every candle represents one trading minute:

Now when I zoom out and scroll to the right, look at the resulting move on Monday after the open:

The price slid $6 per share intraday.

And thanks to the nature of options, we can take advantage of this bearish price action without opening a short position.

Instead, we can buy a put contract that gives us the option to sell shares at a higher price even if the stock falls lower.

Then we sell the option contract as it gains value as the QQQ fades.

But … How did I know the price would fall?

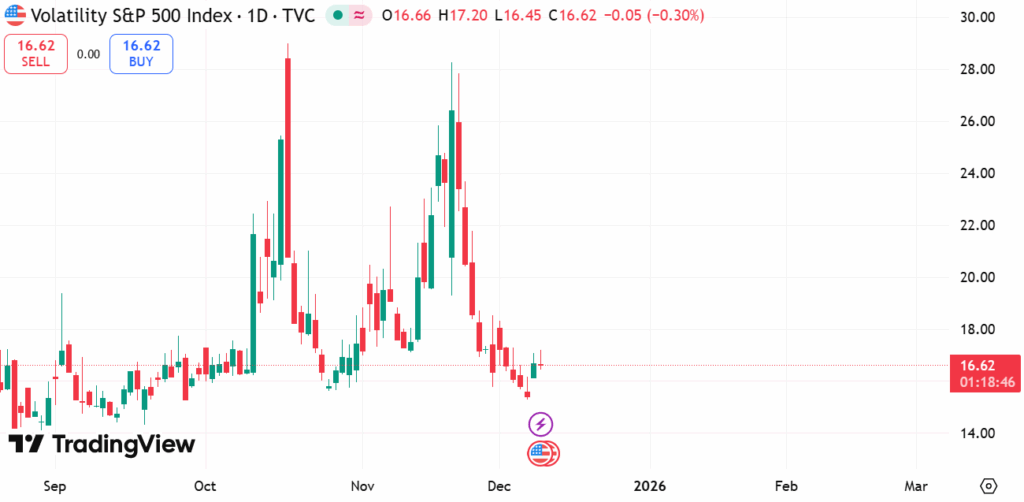

The VIX

The VIX, short for the CBOE Volatility Index, measures the market’s expected volatility over the next 30 days based on S&P 500 option prices.

It’s often called the “fear index” because it rises when investors expect turbulence and falls when markets are calm.

The VIX attempts to reflect future expectations. It’s derived from the prices that traders are willing to pay for options contracts.

- When fear or greed rises, option premiums increase, and so does the VIX.

- When confidence returns and the market slows down, premiums and the VIX drop.

Typically, a VIX below 20 signals a calmer market, while above 20 indicates uncertainty or volatility to come. During crises, like 2008, the VIX has spiked above 80, showing extreme panic.

During Trump’s tariff scare in 2025, the VIX jumped to 60.

In short, the VIX is a barometer of market volatility going forward.

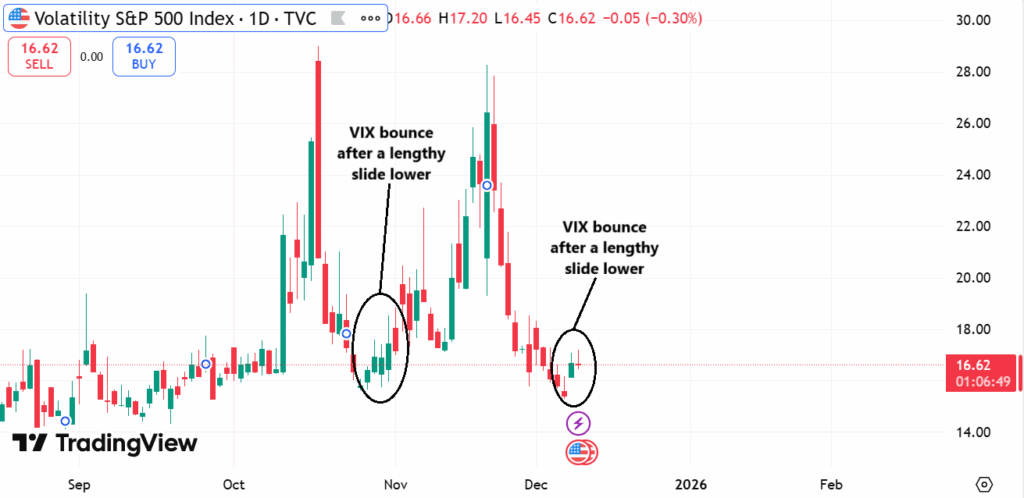

Here’s a chart of the VIX where every candle represents one trading day:

As you can see, to end November and begin December, the VIX was falling pretty drastically.

Traders were calming down as we approached the Fed decision that’s expected today, December 10.

But on Monday, December 8, I saw something in the VIX that led me to a bearish thesis for the QQQ.

An Options Selloff Strategy

When the market is pushing steadily higher, and the VIX is steadily falling, a noticeable divergence in the VIX can signal a price divergence for market indexes as well.

When we look at the VIX chart next to the QQQ, we can see this momentum as clear as day.

Look at the charts below where I annotated the moves:

Here’s the QQQ over the same time frame:

The most recent dip might not look like much on the QQQ chart. But we saw the intraday price action: A selloff of $6 per share.

There’s a ton of meat on the bone for options traders who want to capitalize with this pattern.

- Forget about buying real shares. The QQQ only moves a couple percentage points intraday.

- Forget short selling. The risk of an upside squeeze isn’t worth it.

- Forget stock trading in general!

Instead, we can trade both sides of the market’s momentum with options contracts.

- Call options for bullish moves.

- Put options for bearish moves.

With a sound understanding of the market and key technical analysis (like comparing the VIX with major indexes), you’ll wonder why you didn’t give up on stock trading years ago.

I never would have bought shares of the QQQ as a stock trader.

But as an options trader, these larger assets offer real opportunities, even for those with a small account.

Keep your head on straight as we approach the Fed’s interest rate decision this afternoon. I expect the volatility to surge one way or the other …

And whichever way it goes, I’ll be there to ride the momentum.

Stay Street Smart,

Jeff Zananiri