There’s a trend developing in 2026 …

And the effects have yet to truly ripple through the market.

Just three weeks into the new year, events in Venezuela and Iran are creating a geopolitical tinderbox.

On January 14, the United States completed its first round of Venezuelan oil sales, valued at roughly $500 million, under a broader Washington-Caracas energy agreement that’s expected to accelerate in the coming weeks.

That’s only part of the story. On the other side of the world, renewed unrest in Iran and the specter of U.S. retaliation put fresh pressure on Middle East supply dynamics. Even though major disruptions have yet to hit physical exports.

Thus far, the market has reacted subtly: Oil prices climbed to seven-week highs on Iranian supply fears. Then prices pulled back when diplomatic signals suggested a pause in escalation.

This is especially interesting for traders because much of this geopolitical risk isn’t fully reflected in broader commodity and equities pricing yet.

There’s a growing inefficiency in the market.

Everyone’s distracted by a completely different sector.

Trading Inefficiencies

In January, U.S. forces escalated their campaign to choke off sanctioned Venezuelan crude oil.

They’ve intercepted and seized multiple tankers linked to Caracas. These acts are part of a broader naval blockade aimed at disrupting oil exports and tightening pressure on sanctioned regimes.

One of the most recent tankers apprehended had ties to Russia and was intercepted after a long pursuit across the Atlantic. Which highlights how far this pressure campaign has spread.

At the same time, tension around Iran’s internal unrest and the threat of U.S. intervention has injected another dose of geopolitical risk into the energy markets. Iran remains a major oil producer and controls the vital Strait of Hormuz. More unrest in that area could quickly put real supply at risk.

Not to mention the ballooning energy demand from AI and tech companies that promises to strain energy suppliers in 2026.

While all this quietly tightens the energy complex, the market’s attention is largely elsewhere. Namely, the explosive moves in hard assets.

Gold smashed through record highs in early January, climbing well past $4,600 an ounce on waves of safe-haven buying driven by geopolitical uncertainty and weakening confidence in fiat currencies. Silver has likewise surged to new highs multiple times in January.

The catalysts that could eventually push oil to move more dramatically are being drowned out for the time being by the runaway rally in gold and silver.

It’s a classic sign that fear, not fundamentals, dominates market psychology right now.

This divergence is exactly the kind of inefficiency that traders thrive on. And as geopolitical risks continue to simmer, the oil complex could be next in line for a price surge.

My Trade Plan

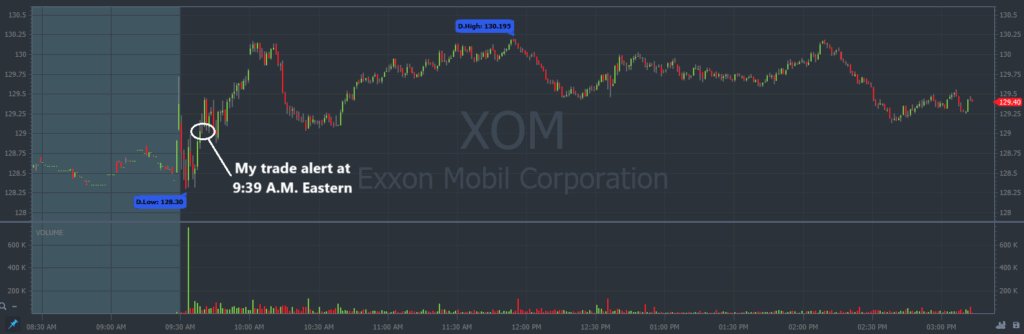

I alerted an energy sector trade on January 15 after Exxon Mobil Corporation (NYSE: XOM) pushed to new all time highs the day earlier.

On the chart below you can see when my alert came out to buy Call options for XOM.

Every candle represents one trading minute:

As impressive as the all-time high breakout is for XOM … It’s nothing compared to the volatility in the hard-asset sector.

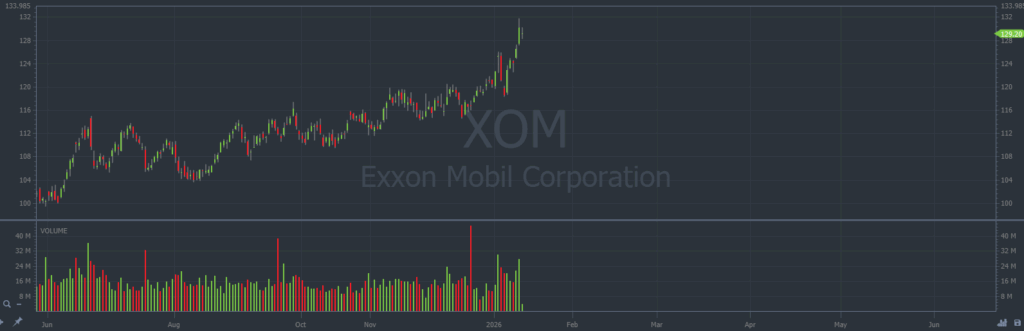

Here’s XOM with one day candles:

Here’s the iShares Silver Trust (NYSE: SLV) over the same time period:

XOM spiked 12% since December 1, 2025. Compared to SLV’s 60% spike over the same time frame.

There’s a clear favorite in the market right now.

But as the hype fades around precious metals, and the effects of the recent oil-trade disruptions gradually creep into the market, I think we’ll see these sectors flip.

Especially if tensions increase between the U.S. and Iran.

The charts for gold and silver are increasingly over extended. I’m still looking to trade a pullback on these assets.

And if the oil sector picks up speed, I’ll look to position myself for more bullish trades like the one on XOM from January 15.

Remember: We can trade both sides of this volatility.

Stay Street Smart,

Jeff Zananiri