I feel it, same as you …

Inbox drama is at a fever pitch.

- Hot takes to provoke your emotions.

- Breaking news alerts.

- Wall Street stories that beg you to take a peek.

Don’t waste your attention on that meaningless crap.

To capitalize on this volatility, you need to shrink your world view. There are only two market gauges worth your attention right now.

Together they tell the story of the market in 2026.

I’m not talking about a secret corner of the stock market or some exotic pairing of assets.

These tickers are in plain sight.

Ignore the side stories.

This year is already shaping up to be a wild ride. The volatility is great for our account, but only if we know how to ignore the confusing noise in the news.

The Big Engine With Fragile Nerves

The first index to watch is a tech-heavy asset built on a handful of giants.

The top stocks included, think Nvidia, Apple, Microsoft, Amazon, dominate the tape. Every wobble in mega-cap tech shakes the market’s mood surrounding this index.

Lately, it’s been hovering near all-time highs as earnings season kicks off, which keeps bulls brave, but also keeps everyone asking if we’re over extended. Global watchdogs have flagged “stretched” valuations in U.S. tech, noting the risk of a sharp correction if sentiment flips.

Here’s where I’m at: I took a bounce trade last week as it reclaimed momentum toward the highs. That was a trade, not an investment. And it was based on intraday volatility due to larger market fears.

The bigger story is 2026 as a whole. This index could absolutely dip further before restrengthening. Leadership concentrated in a few names can cut both ways.

If those leaders exhale, the whole index feels it.

The index: Invesco QQQ Trust (NASDAQ: QQQ).

On the chart below, every candle represents one trading day:

The Challenger That Loves Chaos

The second gauge is the small-cap arena. The place momentum migrates when the big engine hiccups.

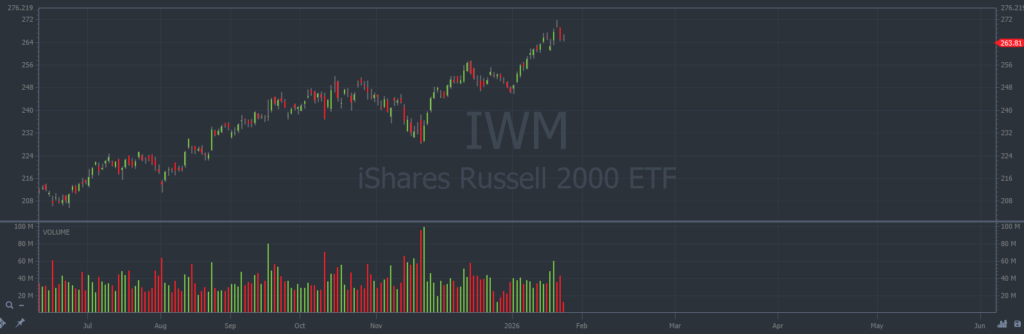

Early 2026 has already shown that strength: Small caps have ripped ahead of large caps, with the iShares Russell 2000 ETF (NYSE: IWM) outpacing mega-cap tech as talk of a “Great Rotation” picks up.

Multiple analysts make the same case: Easing Fed policy, big-tech fears, and improving bank/credit footing create a tailwind that can keep this index running.

This is the yin to the QQQ’s yang. When the big tech gauge stalls or pulls back, greed and momentum can pivot to pour into small caps.

That tension between the two should only build through 2026.

More tension means more volatility. And that’s where we find our favorite trade setups.

We want volatility with a compass: If big tech fades and small caps spike, we can target liquid small-cap leaders for breakouts to new highs. If tech reasserts and small caps tire out, we flip the playbook.

On the chart below of the IWM, every candle represents one trading day:

When these two gauges oppose each other, our patterns show up more cleanly and we have more conviction.

That’s how we trade in 2026. By riding the strongest yin and yang moves, and not the headlines desperate for views.

Stay Street Smart,

Jeff Zananiri