Most new traders think the market is rigged against them.

They look at Wall Street’s billion-dollar firms and think, “How can I compete with that?”

But there’s a twist nobody talks about …

Those massive funds, the ones with hundreds of employees and algorithms firing off trades by the millisecond, they’re forced to keep trading.

They can’t sit still.

They have to deploy capital, manage risk exposure, balance sectors, hedge their positions, all to satisfy clients and show progress on the books.

In short, they’re slaves to trading.

And that reality opens a perfect window of opportunity for us, small-account traders who don’t need to trade at all times.

We just need one or two great setups every few days. And we can find them in the chaos created by institutional overtrading.

When big money floods in or panics out too quickly, prices disconnect from reality momentarily.

That’s when the inefficiencies appear. And that’s the real edge of a nimble trader.

Not size. Not speed. Precision.

It’s why I’ll always say: The market isn’t rigged against you. It’s actually rigged to help you, if you know how to read this momentum.

Trading Inefficiencies

One of the most powerful edges you can develop as a small-account trader is reading institutional overtrading and exhaustion.

When big funds get scared and sell too fast, or get greedy and buy too fast, the price gets temporarily disconnected from reality.

That’s the moment where these setups form. And they’re not random. They follow a pattern:

- A catalyst hits: There’s a news event, an earnings release, or a business update.

- Big money overreacts: Aggressive selling or buying.

- The price overshoots a fair value.

- Then it retraces toward equilibrium.

As a nimble trader, you don’t need to be in every rotation. You just need one clear imbalance where you can define your risk and your target.

That’s why I often look straight to names that are oversold in strong sectors.

Here’s one I like this week …

The Opportunity on Bank of America (BAC)

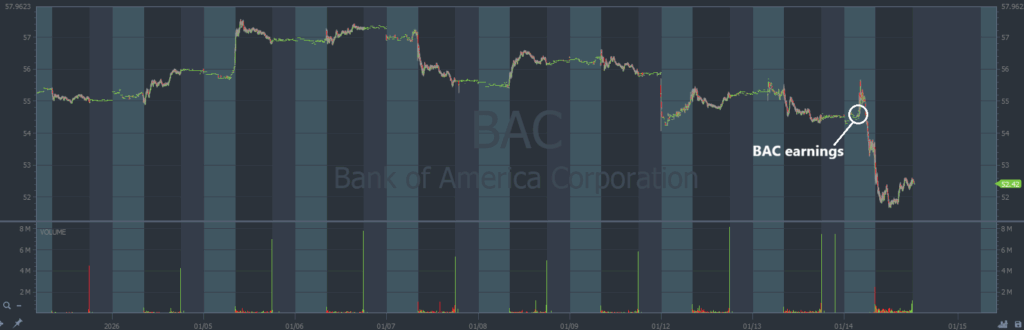

Bank of America Corporation (NYSE: BAC) recently slid lower for multiple trading sessions in anticipation of and despite the bullish earnings report yesterday morning, January 14.

The company posted better-than-expected earnings and a strong revenue beat early in its latest quarterly report.

BAC’s earnings topped consensus, with revenue around $28.4 billion and earnings of $0.98 a share.

In banking overall, fundamentals remain surprisingly resilient. Net interest income is up, trading desks are benefiting from volatility, and big banks are still reporting solid quarterly profits.

And now, the last major catalyst for BAC (earnings) is out of the way. Traders who needed a reason to sell already got it. That leaves the stock oversold into an area where we could see a substantial bounce.

On the chart below, every candle represents one trading minute:

From Wednesday, January 14, the chart shows a lot of good sideways consolidation just under $52 per share after a comparatively massive selloff.

That can act as a perfect risk level for our trade.

Thanks to the greedy Wall Street players who need to buy and sell shares all day long, stocks like BAC can work themselves into price areas that are inefficient with the overall value of the stock.

This trade offers a great risk/reward ratio. And it’s not the last setup we’ll see in 2026.

Part of the reason why banks keep making money is because more people are trading. That adds to the volatility in the market.

Which is why I think 2026 could be the best year for trading yet.

Study this setup and other recent trades we’ve made. The more exposure you get to the market, the quicker you’ll gain self sufficiency.

Stay Street Smart,

Jeff Zananiri