Good morning, traders…

Jeff here.

It’s officially Spring Break, and I’m taking my family to the beach for a few days.

Sand, sun, maybe a few piña coladas, and most importantly — time away from the screens.

It’s important to take breaks. Breathe some fresh air. Get your head out of the noise.

Markets don’t care if you’re tired, burned out, or overdue for a mental reset. They just keep moving.

But just because I’m taking a breather doesn’t mean I’m not watching what’s around the corner.

Volatility will return — probably sooner than most expect. I’ve got a big red circle around the upcoming tariff deadline.

Most people are ignoring the risk. But that’s exactly when the market likes to catch folks leaning the wrong way.

That’s the trick. When everyone’s lulled into a short-term bounce, a shocking headline drops, and the whole game shifts.

That’s why you can’t afford to get complacent.

With that in mind, let’s get to my Tuesday Market Outlook for the week…

Fundamentals? Forget About Them!

Over the past few weeks, I’ve been trading with both hands…

Buying calls, taking shots, and putting some ridiculous trades on the board.

Just yesterday, I hit a 400% gain on iShares Russell 2000 ETF (NYSEARCA: IWM) calls.*

No magic there — just being in the right place at the right time with a setup that made sense.

I’m also building something new — an overnight index trading system for identifying options one day out.

And let me tell you, it’s been working like crazy. In this market, you need a reliable system like that, because logic isn’t really working right now. This market isn’t about fundamentals.

You think you can analyze your way through it with some neatly written thesis? Good luck. That’s not what’s moving the tape.

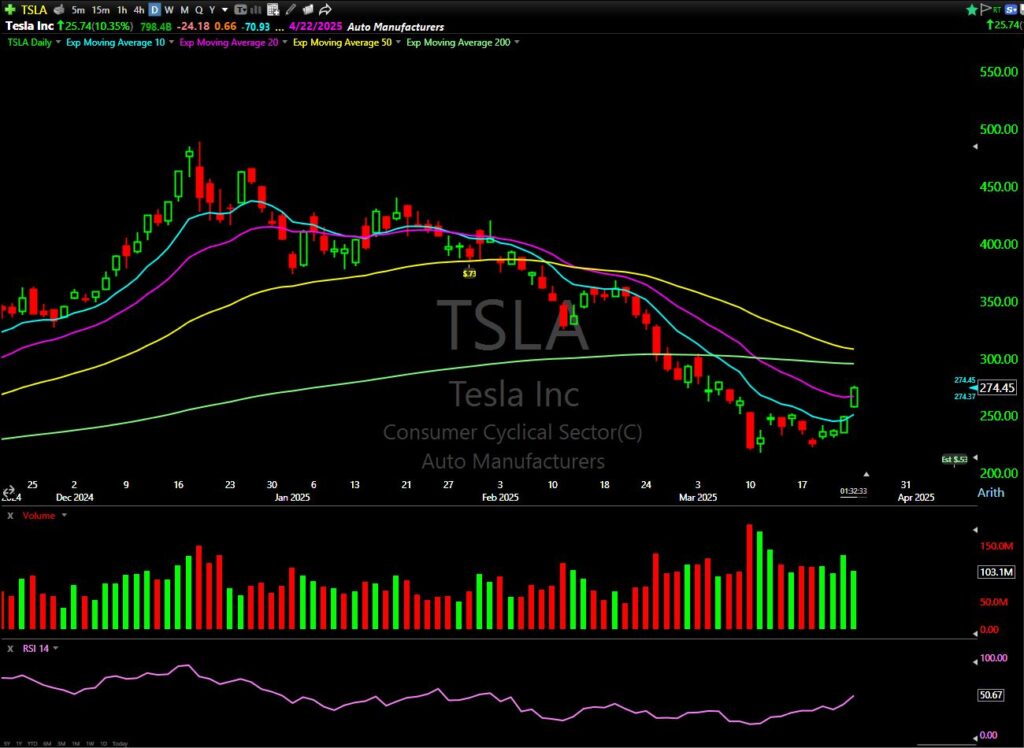

I’m hearing people spin stories about Tesla’s fundamentals, talking about car fires and battery recalls.

Meanwhile, right after those news stories come out — the stock runs 10%, 12%, 15%, and now 25% off its recent lows:

If you’re still trying to make sense of it like a fundamental analyst, you’re playing the wrong game.

This market doesn’t reward rational thought. It rewards execution. It rewards speed. It rewards being willing to flip your opinion in an instant and go the other way.

The Right Moves For This Market

I’ve said it before and I’ll say it again: it’s time for short-term plays. You need to trade what’s in front of you.

That means having a plan, hitting singles and doubles, and trading quickly.

Some names have been red hot in this relief rally, and they’ve run too far, too fast. That’s part of the game. Know when to back off.

If a name’s already made its move, don’t force the trade. Just cross it off the list and move on.

Adaptability is the whole ballgame right now.

So yeah — I’ll be on the beach this week. But my eyes are still open.

If something pops up worth acting on, I’ll be ready. If not, I’ll be recharging, clearing my head, and getting ready to come back sharp next week.

Happy trading,

Jeff

P.S. Last earnings season, Ben Sturgill’s Earnings Edge System had 100 winning trades in a row — don’t miss the next 100…*

TODAY, March 25 — you have TWO GOLDEN OPPORTUNITIES to join the great Danny Phee for a LIVE EARNINGS WORKSHOP — 2:00 p.m. and 8:00 p.m. EST — Click here to reserve your seat!

*Past performance does not indicate future results