You ever watch a freight train slow to a crawl?

That’s what happened to the U.S. economy last quarter.

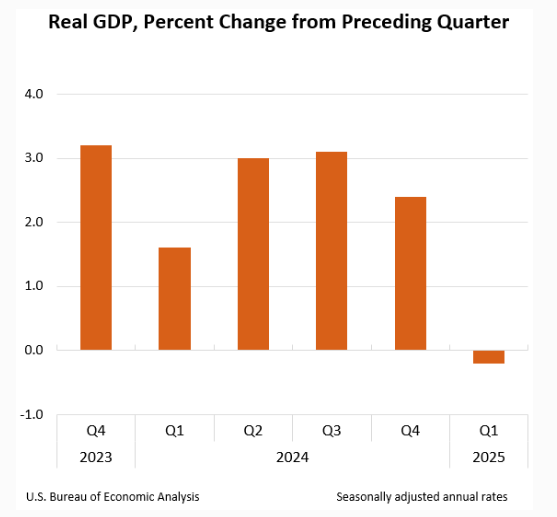

GDP contracted at 0.2% — the first dip in a while after a decent 2.4% climb the previous quarter.

That kind of turn doesn’t happen in a vacuum.

It’s a sign of an economy that’s hitting the brakes whether Wall Street wants to admit it or not.

Here’s how to trade it.

What’s Behind the Slowdown

The culprits?

Imports surged and consumer spending cooled off.

That’s not exactly a vote of confidence from the folks holding the purse strings.

Now throw in a legal curveball …

A federal judge just slapped down a big chunk of Trump tariffs, saying they were pushed through without proper authority.

That news had traders immediately repositioning.

Futures popped, the dollar firmed up, and anything tied to global supply chains got a little boost.

If these tariffs don’t hold up, it could ripple across commodities, affecting billions in goods.

You can’t shrug that off.

Markets hate uncertainty. But they love clarity.

And this ruling is a step toward clearing up what’s been a foggy tariff situation for a while now.

The appeals process might drag on, but traders are already sniffing out which sectors could get tailwinds if the tariff walls start coming down.

Eyes on the Numbers

If that wasn’t enough to keep your screens full, we’ve got a stack of critical economic reports hitting today.

I’m talking consumer spending, PCE, and consumer sentiment.

These reports are direct signals into the Fed’s next move.

If spending stays soft and inflation shows signs of cooling, you might hear whispers of rate cuts getting louder.

If inflation sticks and sentiment tanks? Markets could choke.

Either way, if you’re trading blindly through this, you’re toast.

This is one of those times where sitting on your hands isn’t a strategy, it’s a risk.

You’ve got opportunities opening up fast, but only if you’re sharp enough to catch them.

Stay plugged in, stay nimble, and keep your exposure tight until the data gives you confirmation.

Stay street smart,

— Jeff Zananiri

Want to spot the next big move before it hits the headlines?

Join Aaron Hunziker Saturday at 8 p.m. ET for a breakdown of the real signal smart traders are watching right now.

He’ll walk you through the structural trigger that’s popped up ahead of major market moves before — and it’s flashing again.

👉 [Save your spot here.]