In case you hadn’t noticed … The market is getting more volatile as we venture further into 2026.

Major silver and gold stocks shot even higher yesterday after the already incredible run that started 2026.

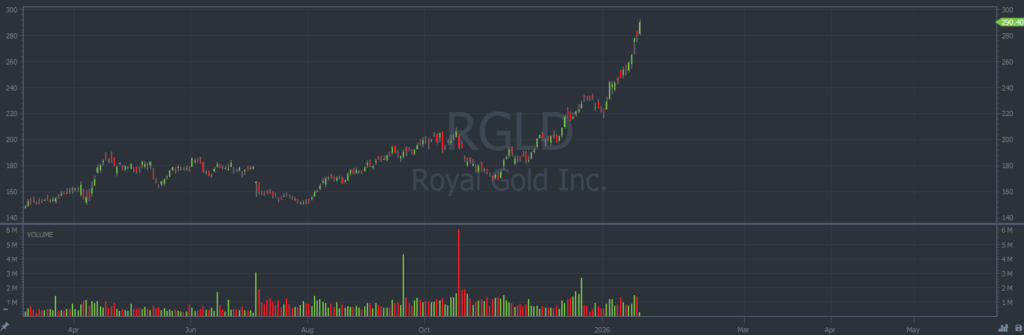

Below you can see charts of the iShares Silver Trust (NYSE: SLV) and Royal Gold Inc. (NASDAQ: RGLD). On each chart, every candle represents one trading day:

This is a trader’s paradise.

But if there’s one thing I know for certain, it’s that this volatility won’t last. The market ebbs and flows. Sometimes it’s hot, sometimes it’s cold.

Make no mistake, right now it’s red hot. And we need to take advantage of this momentum before it turns on us.

There’s still time. I see this volatility growing into the end of 2026 … But you know as well as I do, time flies.

Snap out of the day-to-day routine that’s getting you nowhere.

It’s time to buckle down and change your trajectory this year.

Trade Setups I’m Watching

Right now, the precious metals corner of the market is extremely explosive.

Silver’s move is breathtaking, with SLV up well over 200% in the past year and far outpacing broader markets like the S&P 500.

The surge comes from silver’s dual identity: A commodity with real industrial use and a macro hedge that traders flock to when volatility spikes in equities.

Markets are seeing some of the highest implied volatility for SLV in years, signaling that swings, both up and down, are likely to persist.

Gold wasn’t left behind. Precious metals overall are benefiting from inflation concerns, central bank buying and geopolitical uncertainty, adding fuel to swings that can create big opportunities for option trades.

I’m mainly looking for Put trades as these assets exhaust themselves and start to retrace lower.

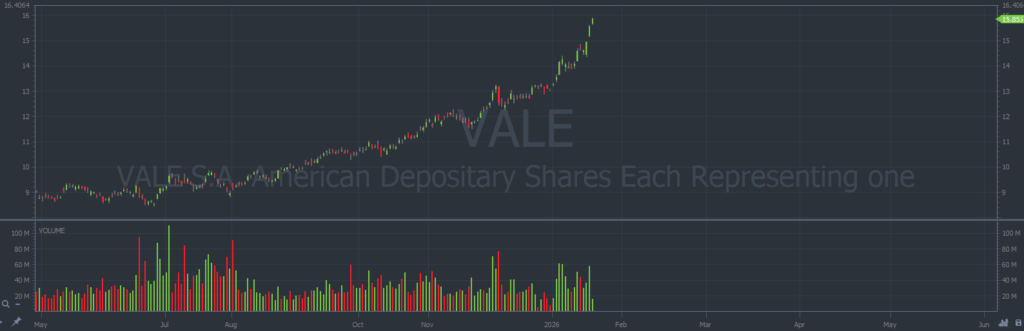

I’m also watching VALE. It’s a major materials stock that surged to new all-time highs today. It’s another extreme move that may be due for a pullback.

On the VALE chart below, every candle represents one trading day:

But it’s not just commodities showing wild moves.

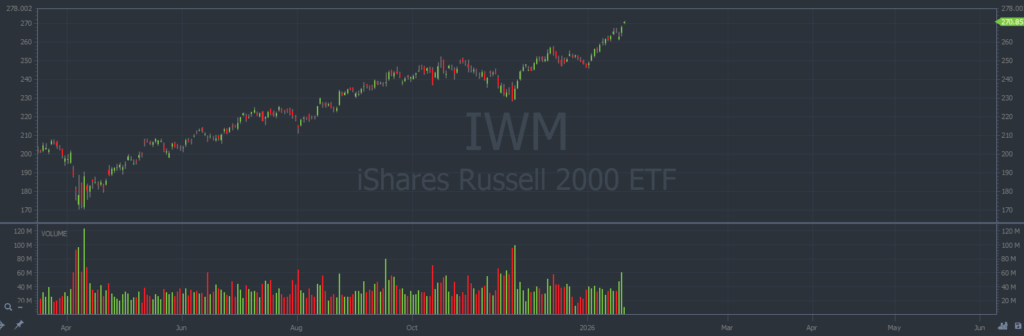

Small-cap equities, as measured by the iShares Russell 2000 ETF (NYSE: IWM), are outperforming large caps, up more than 10% year-to-date and hitting fresh highs.

On the IWM chart below, every candle represents one trading day:

It’s the longest streak of its kind since the 1990s. And it suggests broad risk appetite and elevated volatility across the market.

How To Capitalize

With the market this volatile, now is the exact time traders should look to options, not just stocks.

Volatility is the fuel that makes options valuable.

The percent gain on a stock chart pales in comparison to the percent gain of the corresponding options contract. So when volatility is high, the moves on option contracts are even bigger.

Plus, instead of buying or shorting 100 shares of an overextended name like VALE, you can buy a contract that gives you the same directional exposure for much cheaper.

- Bigger percent gains.

- Cheaper shares.

It sounds like a win-win to me.

Don’t get stuck trying to trade big names with small capital, options are the answer.

And the setups are only getting better …

The market’s already volatile, but some analysts predict more room to run if interest rates ease and company earnings stay firm. All the while, AI valuation fears and geopolitical catalysts threaten a bearish market trajectory.

It could go either way. And I’m loving the volatility that’s involved.

New traders: This is the ONLY strategy you need to focus on.

Follow the checklist. Only focus on the best setups. And get ready for a wild year.

By the time December rolls around, you’ll wonder how it all happened so fast.

Stay Street Smart,

Jeff Zananiri