Everyone dreams of finding the perfect trade setup.

You’re stalking an early spike that has a recent catalyst, the price action falls into a lull right before the surge, and you pull the trigger for the trade of a lifetime.

Well what if I told you … These setups do exist. And they appear like clockwork, several times a year.

Every few months, we see the same pattern: stocks explode higher on fresh catalysts, while others collapse under pressure. It’s a cycle of opportunity that keeps resetting, and soon it’ll start again.

I’m talking about earnings season.

Four times a year, publicly traded companies open their books. And when they do, the market reacts violently.

The winners attract new buyers and momentum traders who chase strength. The losers? They get dumped as fear and stop-losses cascade through the tape.

This is where preparation pays off. You don’t have to predict which stocks will win or lose. You just have to know which ones are lined up with strong catalysts and clean technical patterns before the numbers hit.

When the reports drop, the plan is simple: React, don’t guess.

Trade the chart and ride the post-earnings momentum while others hesitate.

Some of the year’s biggest moves start in this exact window.

This is the season where disciplined traders thrive. Don’t miss it.

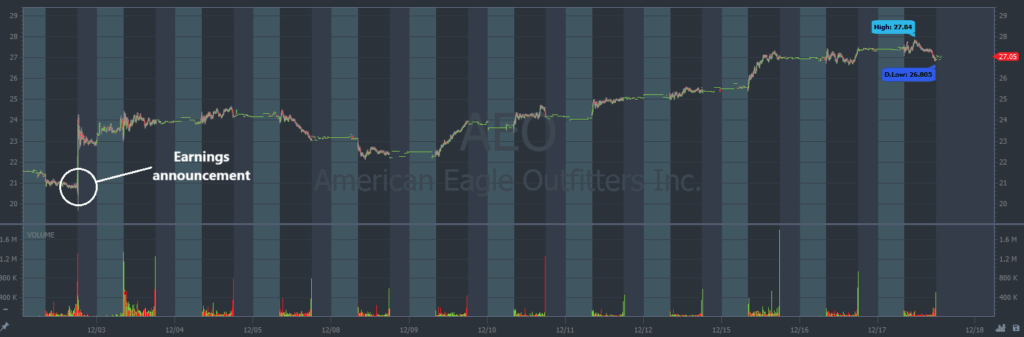

Earnings Example #1: American Eagle Outfitters Inc. (NYSE: AEO)

One of the strongest recent setups we can’t ignore is American Eagle.

A retail name that already surged 30% after reporting blowout quarterly results on December 2. The company beat both revenue and EPS expectations, with $1.36 B in sales (+6% YoY) and $0.53 EPS vs. $0.43 expected, driven largely by strong comparable sales at its Aerie brand.

But what really amplified the market’s reaction was AEO’s high-impact marketing campaign featuring actress Sydney Sweeney.

The “Sydney Sweeney Has Great Jeans” push that quickly went viral, generated billions of impressions, sold out key denim products, and boosted visibility across younger demographics.

That campaign wasn’t without controversy, yet the brand leaned into the momentum rather than shy away, and the buzz translated into real traffic gains and heightened consumer engagement.

There were multiple opportunities to build a position in this stock as it walked higher.

On the chart below, every candle represents 2 trading minutes:

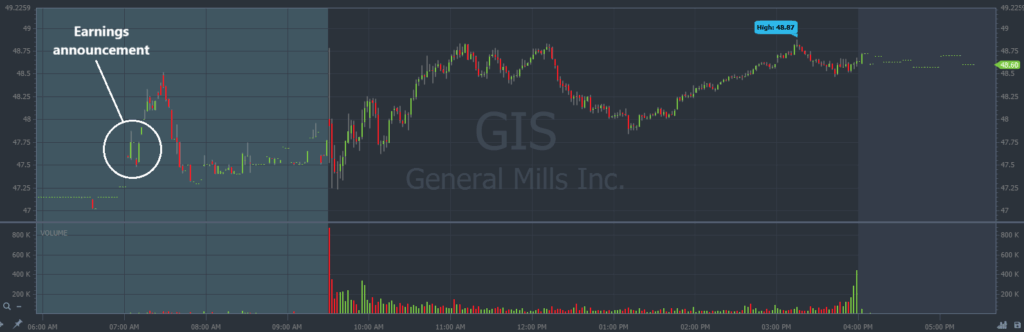

Earnings Example #2: General Mills Inc. (NYSE: GIS)

General Mills delivered one of the most interesting fundamental turnarounds of the recent earnings season.

The company announced results during premarket on December 17, showing that its aggressive price-cut strategy is finally paying off.

After months of grocery inflation weighing on consumers, General Mills cut prices across roughly two-thirds of its U.S. grocery lineup.

The company reported adjusted earnings of $1.10 per share, beating analyst expectations of $1.03. While revenue dipped 7% to $4.9 billion, the market focused on the volume recovery and stronger consumer response to lower prices.

Shares popped 3% and closed strong on the day.

On the chart below, every candle represents 1 trading minute:

GIS announced earnings outside of the more generally accepted earnings season, and it’s still showing good momentum.

Keep an eye on this stock. Yesterday was just day one.

Preparation Meets Opportunity

Earnings season is a repeatable playbook for traders who know what to look for.

Four times a year, volatility spikes, charts surge or crash, and opportunity floods the market.

Stocks like AEO and GIS prove the powerful duo of a clear catalyst and clean price action.

They both gave us solid trade opportunities. But the earnings story is different for each. That’s the beauty of this cycle. Different stories, same pattern.

Study the setups, plan ahead, and react with precision instead of emotion. Soon you’ll start to see the rhythm too.

It’s the same process that fuels the best traders year after year. The next round of earnings is already on the horizon. It begins mid-January.

Start preparing now! Because these stock spikes won’t wait for you.

Stay Street Smart,

Jeff Zananiri