Good morning, traders.

We finally got the GDP number. And, yeah — it’s not pretty.

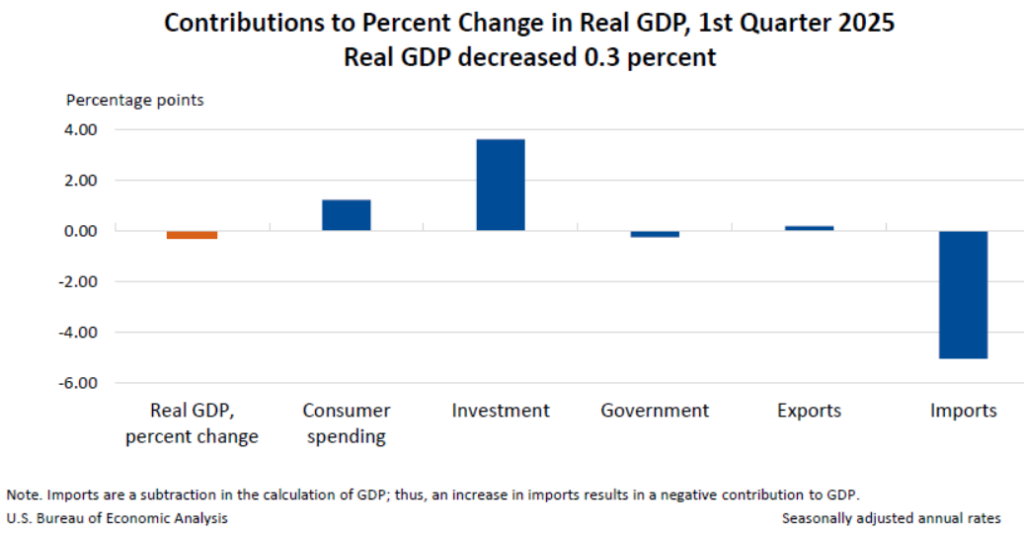

Down 0.3% on the quarter.

That headline has been bouncing around the media like a pinball, and if you just skimmed it, you’d think we’re already halfway to a full-blown recession.

To say people are anxious right now is putting it mildly.

But let’s slow down for a second and look at what’s really going on.

This isn’t some catastrophic collapse in consumer spending or a sign the American economy is grinding to a halt.

In fact, if you dig into the numbers, personal consumption rose 1.8% in Q1 — higher than most expected.

Businesses are still investing, and fixed investment actually ticked up.

That’s not what a crumbling economy looks like.

That’s strength.

So, why the ugly headline number?

Let’s break it down.

Imports Just Sank the Ship — At Least on Paper

The biggest hit came from net trade.

Imports surged — and that subtracts from GDP.

By itself, trade knocked 5 full percentage points off the growth figure.

That’s massive.

Now, are Americans importing more because they’re nervous and hoarding goods?

Maybe.

But it’s also possible companies are front-loading shipments out of fear of future tariffs or supply chain disruptions.

And let’s not forget: Higher imports usually mean higher demand. You don’t import more if nobody’s buying.

So, while it crushed the math behind GDP, this spike in imports may actually signal underlying economic momentum, not weakness.

Government Spending Fell — And That’s Not Necessarily Bad

The other drag was government spending. And let’s be honest: Less government spending isn’t a red flag.

In this case, it just means Washington wasn’t pumping as much cash into the system as it had been in recent quarters.

That can slow GDP in the short term, sure.

But it’s a healthy sign that we’re beginning to normalize after years of stimulus and emergency support.

Fewer handouts and a more self-sustaining economy?

I’ll take that any day.

Consumer Confidence Is Slipping — and That’s Where the Trouble Might Be

What is concerning is the mood shift happening on Main Street.

Consumer confidence in April fell to its lowest level in almost five years. The Conference Board’s gauge dropped nearly 8 points, down to 86.

That’s the fifth straight monthly drop — and the longest decline we’ve seen since 2008.

People are worried.

About inflation. About layoffs. About tariffs and political nonsense.

And they’re not wrong.

We’ve got major companies — JetBlue, GM, Snap, Volvo — throwing up their hands, saying it’s nearly impossible to forecast anything because of global trade tensions and economic crosswinds.

That’s a big deal.

When companies can’t plan, they can’t hire or invest confidently.

And when consumers get spooked, they stop spending.

That feedback loop can spiral if it lasts long enough.

The Disconnect Between Data and Feeling

Here’s the weird part: The data isn’t awful. But the vibe is.

GDP looks worse than it is because of technical factors (imports, government spending).

Meanwhile, the underlying drivers — consumption and investment — are still holding up.

But if enough people feel like we’re in trouble, that perception starts to shape reality.

That’s where the real risk lies right now. Not in the data, but in the psychology of the market.

So, What Do You Do With This?

If you’re a trader, stay nimble.

Volatility will stick around as long as uncertainty is this high.

Expect whipsaw moves, especially around earnings and economic releases.

If you’re an investor, don’t panic — but don’t go full throttle either.

We’re in a phase where sentiment is more important than spreadsheets.

That’s a tough environment to bet big in either direction.

And if you’re just someone trying to make sense of it all — understand this: We’re not in a freefall.

But confidence is fragile.

Watch the next couple months closely.

If confidence keeps dropping while businesses and consumers start pulling back for real … then we’ll have a much bigger problem on our hands.

But for now?

The 3% GDP drop isn’t the full story.

Don’t let the headline fool you.

There’s strength underneath. We just need the sentiment to catch up.

Want to talk more about how I’m trading through all this?

Let’s do it.

Stay sharp,

— Jeff Zananiri

You don’t have to trade every day — but when the right setup appears, you’d better be ready.

This Friday at noon ET, Danny Phee is breaking down how he finds and nails explosive overnight trades … even when the market feels shaky.

If you want the playbook for spotting fast-moving setups before they take off, don’t miss this.

👉 Register now to grab your seat

*Past performance does not indicate future results.